inheritance tax changes 2021 uk

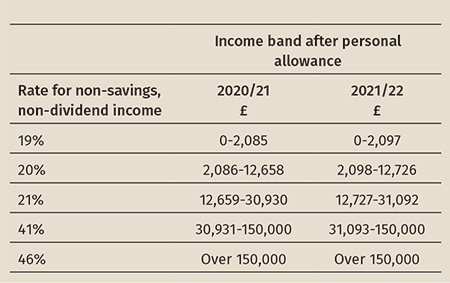

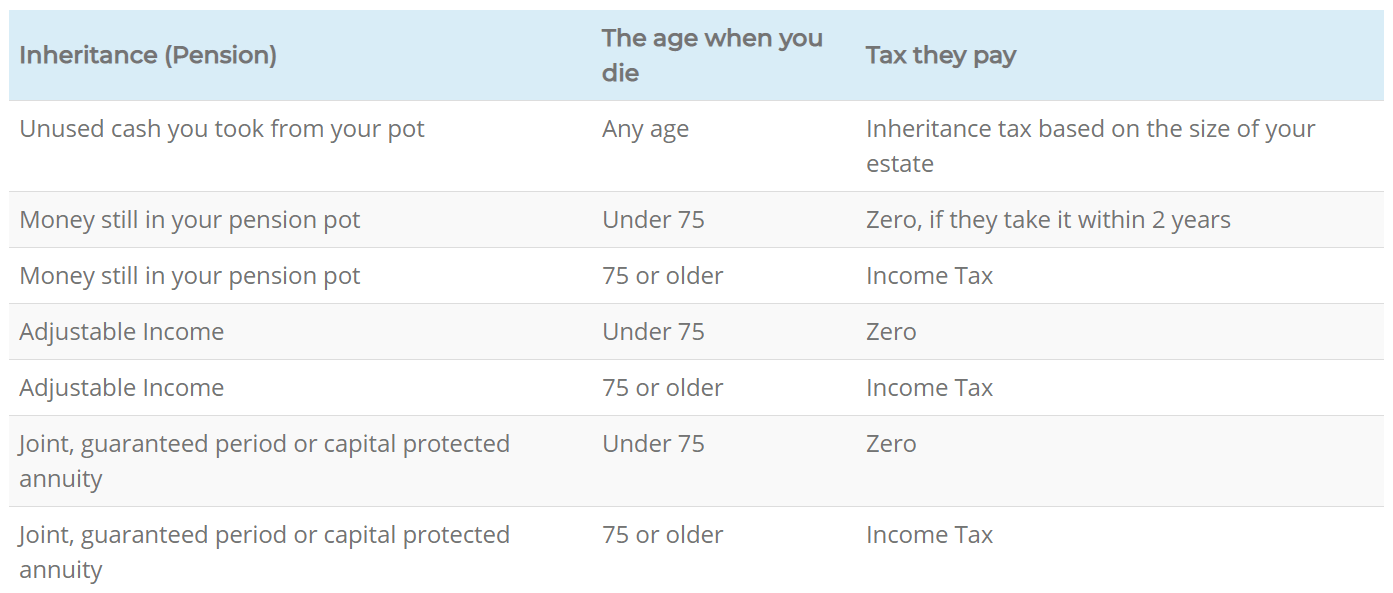

Major changes in the rules on the inheritance of pensions came into force on 6 April 2015. If we assume Simone had other taxable income on her death of 150000 and using UK tax rates Scottish rates of income tax will give different results there would be 270000 income tax to pay.

Inheritance Tax Debate What The Wealthy Need To Know

Complaints financial help when retired changes to schemes.

. Continue reading Personal Allowance. London is considered a safe haven and an attractive destination for investors perhaps more than any other major city in the world some would argue. The allowance has remained the same since 2010-11.

Inheritance tax News Tax retirement Banking. With its solid track record clear legal title and of course lots to do it remains a favourite place for foreign investors in this. From 1780 Legacy Duty an.

Capital Gains Tax CGT. Inheritance tax is calculated on the total deceaseds estate gifts made within 7 years with tax paid on amounts over the nil rate band also known as IHT threshold applicable at the date of death. The flexibility changes have meant more transfers are taking.

UK property is a traditional favourite for investors from all over the world and particularly the UAE. In addition there is a 3000 annual gift allowance that is free of UK. Latest news on Making Tax Digital and what you will be expected to do once the system is in force.

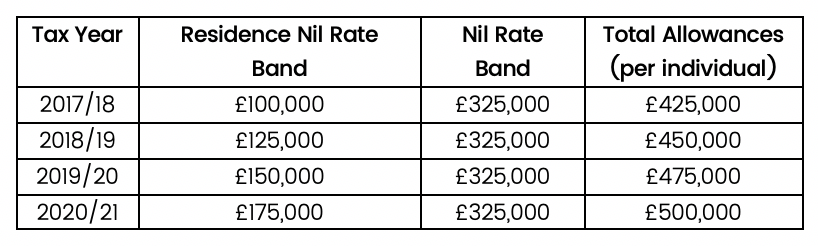

Everyone in the 2022-23 tax year has a tax-free inheritance tax allowance of 325000 known as the nil-rate band. How to amend previous tax returns if youve forgotten to claim expenses. How it works what you might get National Insurance.

Inheritance tax thresholds rates and who pays. Marlborough UK Micro-Cap Growth manager on why huge falls in the shares of nascent British firms isnt a problem. See the situations where inheritance tax may apply in relation to pensions.

The personal allowance is the amount of money that each person can earn before paying tax on their earnings. By Sam Benstead 7 Oct 2021 12. The property allowance will be layered on top of your inheritance tax allowance which has been set at 325000 since 2010.

Over the years there have been numerous inheritance tax changes. Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to hisher world-wide estate as the effect of the new law will be to disregard the deceaseds possible choice of hisher national law made by will. Who can inherit my property tax-free.

Prior to the introduction of Estate Duty by the Finance Act 1894 there was a complex system of different taxes relating to the inheritance of property that applied to either realty land or personalty other personal property. Use the online service or postal form and notes if the person died on or after 6 April 2011 or on or before 31 December 2021 and the estate is unlikely to pay Inheritance Tax. The standard inheritance tax rate is 40 of anything in your estate over the 325000 threshold.

However if an asset is transferred to them from the Estate such as shares or a property for example and they then sell this at a later date for a profit they may become liable for Capital Gains Tax at this stage. The latest guidance on how changes to the rules on accounting periods from 202425 will affect property trading businesses. From 1694 Probate Duty introduced as a stamp duty on wills entered in probate in 1694 applying to personalty.

A Beneficiary will not usually be liable to pay Capital Gains Tax on their inheritance. It was announced in the Finance Bill 2021 that inheritance tax nil rate bands will remain at existing levels until April. Work out whether inheritance tax IHT will be due on your home and possessions when you die how to reduce the amount of inheritance tax due and more.

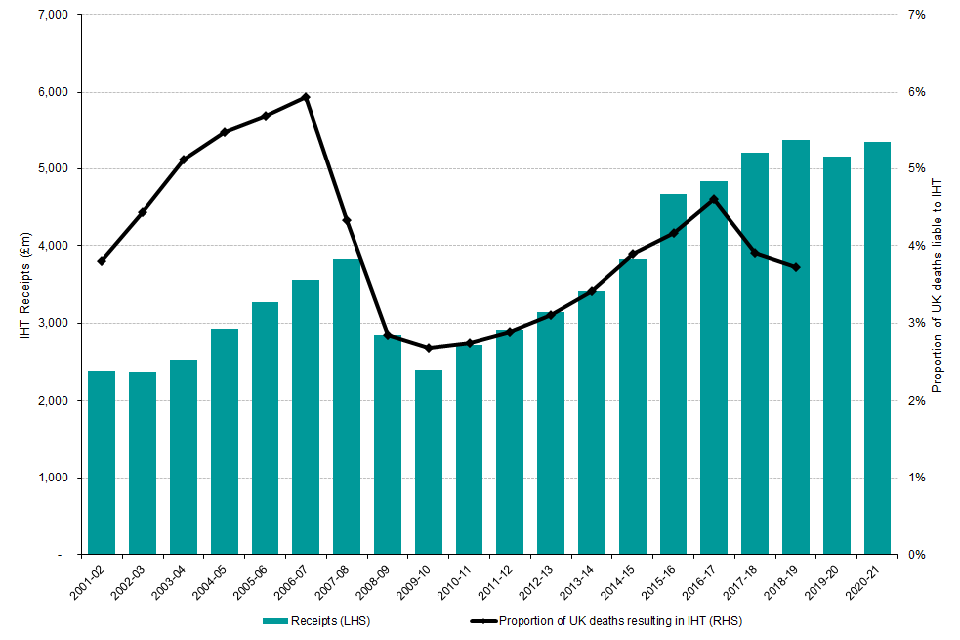

This means that in 2022-23 you can pass on as much as 500000 tax-free as an individual or 1m as a couple. Only 1 in 20 estates in the UK pay Inheritance Tax. The forms have been updated due to changes to the reporting regulations for non-taxpaying estates and changes to the excepted estates qualifying criteria for deaths on or after 1 January 2022.

Put simply if you have a pension fund and you nominate your heirs to get the money if you die. The government has published the personal allowance for 202122 on its website and as such has confirmed that it will increase by the increase in the Consumer Prices Index for September 2020 which stood at 05.

Life Insurance And Inheritance Tax Forbes Advisor Uk

Inheritance Tax Planning June 2022 Uk Guide

10 Jurisdictions With No Inheritance Tax No More Tax

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

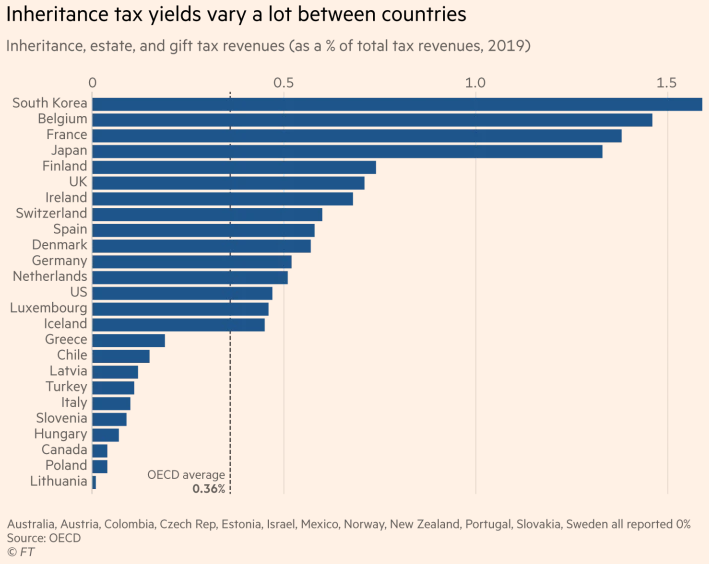

Changes To Uk Tax In 2022 Holborn Assets

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Changes To Uk Tax In 2022 Holborn Assets

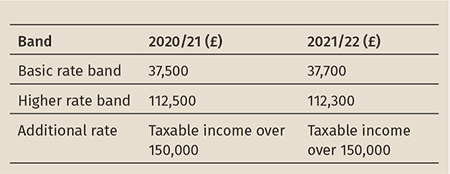

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol

Inheritance Tax Receipts Uk 2022 Statista

January 2022 Inheritance Tax Changes All You Need To Know Key Business Consultants

Inheritance Tax Statistics Commentary Gov Uk

Pfp The Rise And Rise Of Inheritance Tax

Guide To Moving Your Inheritance Abroad Ofx

Inheritance Tax Rules How Will They Affect You 2019 2020 Update